The holding company of the $150-billion salt-to-software conglomerate aims to restructure its balance sheet to avoid a mandatory public listing under RBI’s ‘upper layer’ NBFC norms.The ‘upper layer’ NBFC tag requires companies to follow a stringent disciplinary structure with a mandatory listing within three years of being notified.

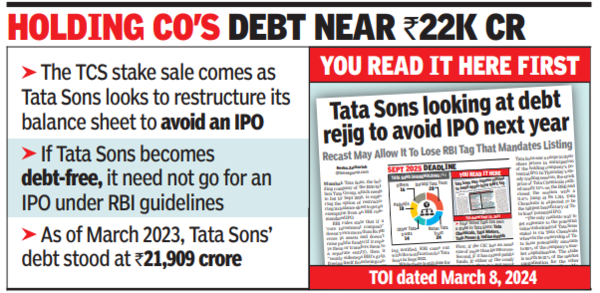

According to Tata Sons’ FY23 report, it has debt of Rs 21,909 crore and cash & bank balances of Rs 451 crore on its books. RBI rules require Tata Sons, which is registered as a core investment company (CIC) with the banking regulator, to be listed by Sept 2025. But the company, controlled by a group of public foundations, Tata Trusts, has been exploring options to avoid the IPO. According to RBI, for the CIC status, a firm has to meet two conditions: First, it has to have an asset size of more than Rs 100 crore, and second, it has to have public funds. If either of the two conditions fail, then it cannot continue to be registered as a CIC with the regulator.

Tata Sons’ assets are mainly its investments in operating companies like TCS, Tata Motors and Tata Steel, and they are worth more than Rs 100 crore. According to its FY23 report, the book value of its investments was Rs 1.3 lakh crore. So, Tata Sons is looking to retire borrowings by becoming debt free, which will enable it to deregister as a CIC from RBI.

The move will help Tata Sons to ‘neatly sidestep’ RBI’s rules, freeing itself from being considered as a CIC and an ‘upper layer’ NBFC, exempting it from going for an IPO, TOI had reported in its March 8 edition. In 2017, Tata Sons had converted itself to a privately held company from a public one amid a boardroom battle between then chairman Cyrus Mistry and Tata Trusts.

Tata Sons has mandated foreign broking majors Citigroup Global Markets and JP Morgan India to sell up to 2.34 crore TCS shares, representing 0.65% of the company for about Rs 9,362 crore ($1.1 billion) through block deals on Tuesday. It has set a floor price of Rs 4,001 apiece for the TCS shares, a 3.7% discount to the stock’s Monday closing, term sheet for the deal showed. After the transaction, Tata Sons will hold a little less than 72% in TCS, down from 72.4% it was holding as of end-Dec 2023, shareholding data on BSE showed.

Once this block trade is completed, at an aggregate value of Rs 9,362 crore, it will be the second biggest block deal in the Indian market in 2024. Last week, global tobacco major BAT, which is the biggest shareholder in ITC, sold a 3.5% stake in the tobacco-to-FMCG major for nearly Rs 17,500 crore.

Even as Tata Sons looks to avoid the IPO, its subsidiary Tata Capital is gearing up for an RBI-mandated IPO.