In this journey from 2,000 to 75,000, the feeling of “it is too high”, especially after big moves, has been common. Such feelings get accentuated around milestones such as 5,000, 10,000, 20,000, 50,000 and now 75,000.

What is surprising is that such concerns are not expressed for the economy which has grown from Rs 1.1 lakh crore in 1979 to Rs 295 lakh crore now.The sensex also started its journey in 1979 at 100.

The sensex represents businesses across sectors and these businesses add up to make the economy. It is, therefore, no surprise that there is a close correlation between the nominal economic growth and the sensex. The former has compounded at 13% and the latter at 16%, from 1979 till now.

The right way to assess the sensex level is to look at it relative to the growth of the economy – when the long-term returns of the sensex are meaningfully higher vs nominal GDP growth, it represents an overvalued market and hence future returns should be that much lower and vice versa.

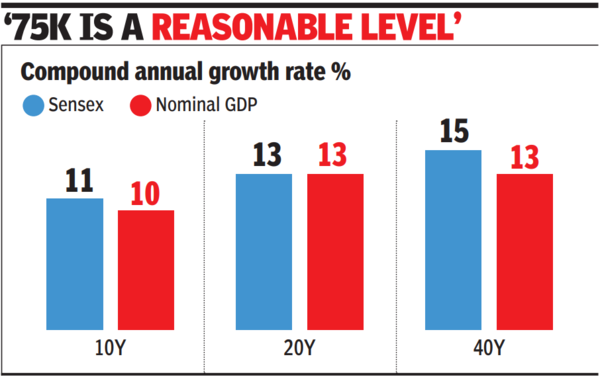

The current 10, 20 and 40 year sensex CAGR is 11%, 13% and 15%, respectively in line with the nominal GDP CAGR of 10%, 13% and 13%.

It, therefore, stands to reason that the sensex at 75,000 is at a reasonable level. Assessing the market levels in terms of valuations also leads to a similar conclusion. Markets are trading at 21x forward PE which is 12% above its 10-year average. India’s improved growth prospects, lower cost of capital and higher domestic equity flows are supportive of marginally higher multiples. Higher domestic equity flows have also reduced the dependence on foreign flows and market volatility.

The above suggests 75,000 shall also pass just like 1,000 in 1990, 10,000 in 2006, 25,000 in 2014 and 50,000 in 2021. While it is justifiable to expect the sensex to move higher over time, return expectations must be realistic, especially in view of the lower inflation. Inflation has averaged 5% over last 10 years (this is sharply lower compared to pre-2000 levels). Lower inflation has lowered nominal GDP growth to 10/12.5% over last 10/20 years. It is no surprise that the sensex has delivered a CAGR of 13% post-2000.

Equity returns closely track the nominal GDP returns. Over the long-term, past returns for the sensex at 75,000 are inline with nominal GDP growth. While near-term outlook of the equities is always hard to forecast, there are reasons to be optimistic about the sensex to achieve milestones in future.

(The writer is chief investment officer, 3P Investment Managers)