Nifty gained 385 points or 1.8% to close at 21,738 points. Some short-covering by speculators to minimise their losses also added to the gains in the sensex and Nifty during the late hours, market players said. Monday’s strong gains came despite rising crude oil prices on the back of an attack on a US defence base in Jordan by suspected Iran-backed militants.

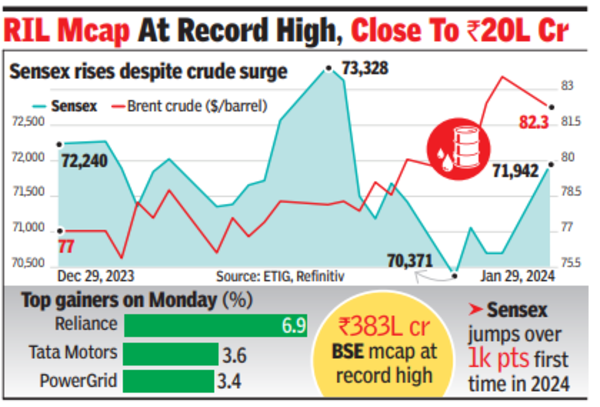

For RIL, it was the best daily gain in about three years, which also took its market capitalisation closer to the Rs 20-lakh-crore mark. At Rs 19.6 lakh crore, it’s the most valued company in India by some distance with TCS at the second spot with a Rs 13.9-lakh-crore market cap. If RIL breaks above the Rs 20-lakh-crore market cap value, it will be the first Indian company to reach that mark. HDFC Bank stock, which suffered losses last week also made a comeback with 1.4% gain. It’s only the third time that the sensex has surged over 1,000 points in the last 12 months.

Gains in other Asian markets also helped investor sentiment on Dalal Street which came mainly on renewed expectations that the US central Bank would start cutting interest rates in the world’s largest economy by the middle of the year. Such a cut could exert downward pressure on most other large economies of the world, other than Japan, to reduce rates, economists and analysts said.

The day’s gains in the domestic market made investors richer by Rs 5.5 lakh crore with BSE’s market capitalisation now at Rs 383.1 lakh crore, an all-time peak. However, it came despite strong foreign fund participation while buying by domestic institutions was nothing extraordinary. End-of-the-session data on BSE showed that foreign funds were net buyers at Rs 110 crore while domestic institutions were net buyers at Rs 3,221 crore.

According to Vinod Nair of Geojit Financial Services, the domestic market underwent an upturn as the recent selloff and positive Asian peers provided an opportunity to accumulate quality stocks.

“Despite premium valuations, confidence is upheld among investors due to the optimistic environment surrounding the interim budget and recent set of results aligning with forecasts. Globally, the upcoming US Fed policy stands out as a crucial factor. While a rate cut by the FOMC is unlikely, investors will eagerly monitor their commentary to get cues on future rate paths.” Of the 30 sensex constituents, 25 stocks closed with gains.