Foreign portfolio investors were net sellers at Rs 8,027 crore, which translates to nearly $1 billion from the stock market during the day – the biggest single-session FPI outflows since mid-Jan.Market players said foreign funds fear greater scrutiny of their money channelled through the Mauritius route after the two countries recently amended the tax treaty.

In contrast to the heavy selling by foreign fund managers, domestic funds were net buyers at Rs 6,342 crore. Index heavyweights like HDFC Bank, L&T and RIL, which also have high foreign holding, were top contributors to the day’s loss.

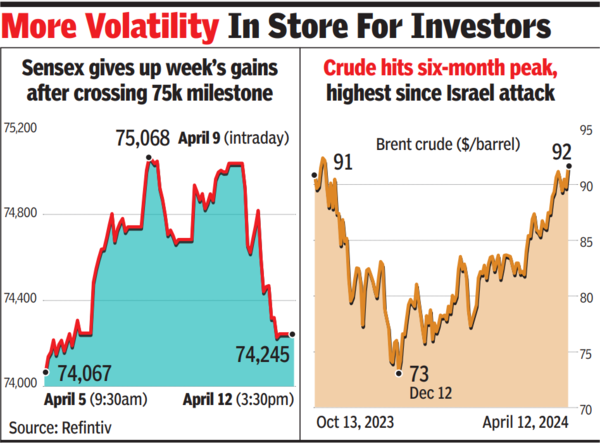

According to Siddhartha Khemka of Motilal Oswal Financial Services, during Friday’s session, uncertainty over the US Fed rate cut timing and concerns about rising tensions between Iran and Israel led to a decline in global markets. “The rise in bond yields due to hotter-than-expected US inflation and amendment in the India-Mauritius tax treaty likely to impact FII flow dampened sentiments.” Given global concerns and the start of an election next week, Khemka expects markets to remain volatile in the near term.

On Wednesday, US govt data showed that consumer inflation rate in the country had jumped to 3.5% in March on an annual basis. The higher-than-expected figure weighed in on investor sentiment, pulling down leading indices and spiking bond yields to multi-month high levels.

Investment into India by FPIs from Mauritius stood at Rs 4.2 lakh crore ($50.2 billion), about 6% of total FPI investments as of March 2024, Reuters reported.