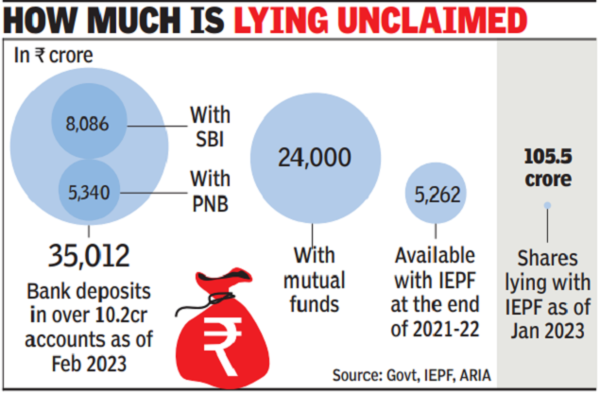

The amounts involved are large. At February-end, nearly Rs 35,000 crore was lying as unclaimed deposits in over 10. 2 crore accounts. Although it is lower than the Rs 48,000 crore last year, the amount lying unclaimed in banks, led by SBI, has nearly doubled from Rs 18,000 crore in 2019.

Similarly, at the end of March 2022, the Investor Education and Protection Fund (IEPF) was sitting on a pile of over Rs 5,200 crore, and this is growing. Under the law, matured deposits with companies, debentures and redemption amounts of preference shares flow into the fund. Similarly, all shares for which dividend has not been paid or claimed for seven consecutive years or more have to be transferred by the companies to IEPF.

IEPF’s latest annual report has estimated that at the end of 2021-22, over 105 crore shares were available with the agency, although the value was not stated. A paper released by the Association of Registered Investment Advisers had estimated that Rs 24,000 crore was lying unclaimed in mutual funds. Industry experts said it is difficult to assess.

Regulators are now expected to push banks, market participants and insurance companies to take up settling of dues on a war footing with the IEPF, under the watch of the ministry of corporate affairs (MCA), too expected toplay a major role. In fact, last month, RBI governor Shaktikanta Das announced the launch of a unified portal so that depositors don’t have to look up multiple websites.

While banks are expected to not just look for depositors or their heirs and assist them in settling the funds lying with them, the situation at the ground level is different, with branch managers often reluctant to settle claims. The situation is much the same with IEPF that settled 26,044 claims and distributed 61 lakh shares and dividends of under Rs 11 crore to the rightful claimants during 2021-22.