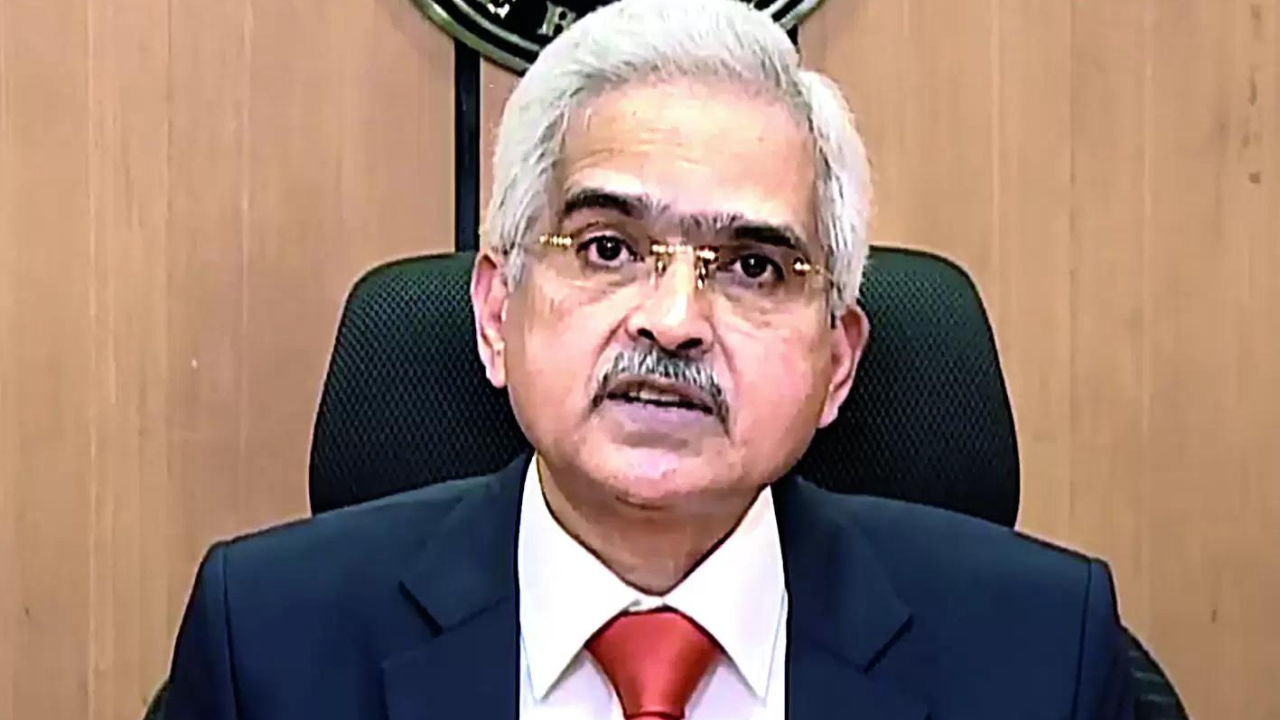

MUMBAI: Ahead of the monetary policy committee meeting on February 6-8, RBI governor Shaktikanta Das appears to be sending a clear message to the markets that rates will remain higher for longer until the policy goal of 4% inflation is met.

“Unless we see clear evidence that inflation is going to sustain at that level, it will be premature to talk about rate cuts.The topic of rate cuts is not on the table, it is not even under discussion. Our focus is now to remain actively disinflationary,” Das told Bloomberg TV in Davos. He said markets are “running ahead of the central banks” globally, which should not be the case.

The governor said that while inflation is within the target range of 4-6%, RBI is working toward achieving the target, which is 4%. “We have to reach 4% and till we reach 4% on a sustainable or a durable basis, it will be too premature for a rate cut,” he said, adding that there were several uncertainties. The comment came a day after he said in a speech in Davos that the economy was expected to grow 7% in FY25 while inflation would be 4.5%.

This is the second time the governor is reminding markets that despite easing inflation, there are no plans to cut rates. Immediately after the monetary policy statement in December 2023, Das said that “loosening of interest rates is not on the table at all”. The improvement in economic conditions appears to embolden the governor to take a hard stance on interest rates. The State of the Economy report published by RBI said that the “Indian economy recorded stronger than expected growth in 2023-24, underpinned by a shift from consumption to investment. The government’s thrust on capex is starting to crowd in private investment”.

The report noted that the potential output is picking up, with actual output running above it, although the gap is moderate. “Accordingly, inflation needs to align with the target by the year’s second quarter, as projected, and get anchored there. Balance sheets of financial institutions need to be strengthened and asset quality improved even further. The ongoing consolidation of fiscal and external balances needs to continue,” the report said.

The third factor making RBI circumspect about easing policy is food price volatility, which was hitherto seen as a transient phenomenon. A report co-authored by RBI deputy governor Michael Patra has said that there are times when food inflation mimics core inflation. “With its large share in the consumption basket, food inflation has the potential to affect headline inflation, and it can also affect non-food inflation in the event of large and repeated food price shocks”.

“Unless we see clear evidence that inflation is going to sustain at that level, it will be premature to talk about rate cuts.The topic of rate cuts is not on the table, it is not even under discussion. Our focus is now to remain actively disinflationary,” Das told Bloomberg TV in Davos. He said markets are “running ahead of the central banks” globally, which should not be the case.

The governor said that while inflation is within the target range of 4-6%, RBI is working toward achieving the target, which is 4%. “We have to reach 4% and till we reach 4% on a sustainable or a durable basis, it will be too premature for a rate cut,” he said, adding that there were several uncertainties. The comment came a day after he said in a speech in Davos that the economy was expected to grow 7% in FY25 while inflation would be 4.5%.

This is the second time the governor is reminding markets that despite easing inflation, there are no plans to cut rates. Immediately after the monetary policy statement in December 2023, Das said that “loosening of interest rates is not on the table at all”. The improvement in economic conditions appears to embolden the governor to take a hard stance on interest rates. The State of the Economy report published by RBI said that the “Indian economy recorded stronger than expected growth in 2023-24, underpinned by a shift from consumption to investment. The government’s thrust on capex is starting to crowd in private investment”.

The report noted that the potential output is picking up, with actual output running above it, although the gap is moderate. “Accordingly, inflation needs to align with the target by the year’s second quarter, as projected, and get anchored there. Balance sheets of financial institutions need to be strengthened and asset quality improved even further. The ongoing consolidation of fiscal and external balances needs to continue,” the report said.

The third factor making RBI circumspect about easing policy is food price volatility, which was hitherto seen as a transient phenomenon. A report co-authored by RBI deputy governor Michael Patra has said that there are times when food inflation mimics core inflation. “With its large share in the consumption basket, food inflation has the potential to affect headline inflation, and it can also affect non-food inflation in the event of large and repeated food price shocks”.