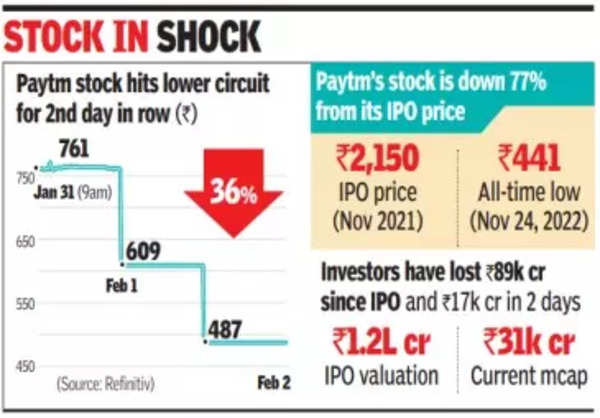

For the second straight day, the stock price of One97 Communications, which operates Paytm, plunged 20% and hit the lower circuit limit at Rs 487 on Friday. Amid the sell-off, a Singapore-based fund managed by Morgan Stanley bought 50 lakh Paytm shares at an average per share price of Rs 487, disclosures to NSE showed. The fund paid nearly Rs 244 crore for the stake.

At Friday’s close, Paytm stock was down 77% from its IPO price of Rs 2,150. The stock got hammered on Friday even after Paytm founder & CEO Vijay Shekhar Sharma assured everyone that the company’s app will continue to work beyond Feb 29.

On Wednesday, RBI barred Paytm Payments Bank from adding funds to any customer accounts, ending the utility of most of its services with effect from March 1. Paytm’s management said the platform will partner other banks after RBI’s action.

At the same time, Paytm’s rivals have started eating into the platform’s market share. “We are seeing a surge in inbound requests from merchants for QRs and smart speakers, and we are making sure we meet that demand,” a PhonePe spokesperson said in response to queries.

Sources said that players like PhonePe and MobiKwik are boosting the presence of their on-ground sales representatives to onboard more merchants.