“India is currently experiencing a mini-Goldilocks moment,” MOFSL said. A Goldilocks moment is one where all situations are ideal. MOFSL is optimistic about India’s medium-term prospects and is confident in selected domestic cyclical trends, including the financialization of savings, resurgence in private investment, growing discretionary spending, revitalization of the real estate sector, and significant advancements in digital and physical infrastructure.

“We do expect intermittent volatility along the way driven by notable events (General Elections 2024), expensive mid- and small-cap valuations, and potential global macro shake-ups,” the report said.

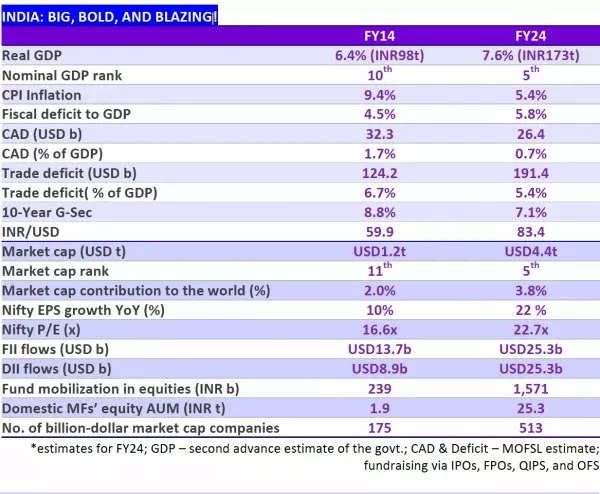

India: Big, Bold and Blazing!

The report goes on to state that India is poised to conclude FY24 with a GDP of $3.6 trillion and a growth rate surpassing 7.6%. Remarkably, capital markets have delivered exceptional returns, with Nifty, Nifty Midcap 100, and Nifty Smallcap 100 witnessing gains of 29%, 60%, and 70%, respectively. India’s market capitalization has surged to $4.4 trillion, positioning it as the world’s fifth-largest economy.

Also Read | Biggest Wealth Creators! Small-cap and mid-cap funds among top performers in last one year; check list here

“India now boasts a unique combination of size and growth,” it said. Projections indicate that India’s GDP may exceed $4 trillion by FY25/26 and $8 trillion by FY34, the report added.

Anticipated political stability post the upcoming Lok Sabha Elections 2024 is expected to further fuel economic momentum, with a focus on infrastructure, capital expenditure, and manufacturing taking precedence. With its substantial size and promising growth trajectory, India’s capital markets are poised for significant expansion in the foreseeable future, the report said. “With size and growth in its wings, India’s capital markets are truly poised to embrace the Amritkaalgoing forward,” it said.