The investment is expected to be in the range of Rs 2,087-2,505 crore ($250-300 million) and will be made through a secondary share sale by existing financial investors, according to an ET report. The valuation of BMS is estimated to be around Rs 7,500 crore ($900 million). This possible investment by KKR highlights the positive turnaround of BMS after facing challenges during the Covid-19 pandemic.

BMS, which is operated by Bigtree Entertainment, is set to achieve its largest fund-raising round. The largest shareholder of BMS is Reliance unit Network18, holding a 37% stake. Other existing investors include Accel, Elevation Capital, Stripes Group, and TPG Growth.

In the last fundraise round in 2018, TPG Growth and other investors injected $100 million (Rs 670 crore) into BMS. The pre-money valuation at that time was $750 million (Rs 5,140 crore). Prior to that, BMS had raised Rs 550 crore in July 2016 at a valuation of Rs 3,000 crore.

Both KKR and BMS declined to comment on the ongoing negotiations.

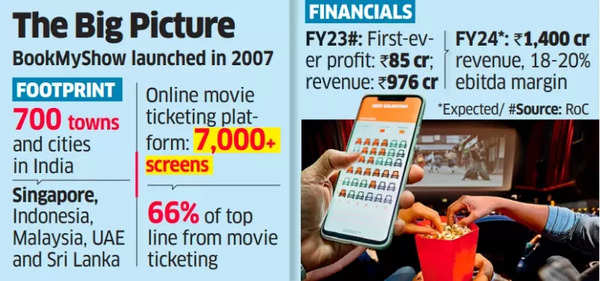

BMS has successfully rebounded from the impact of the pandemic. By selling tickets for various programs and organizing events like Lollapalooza, the company has managed to become profitable. In the fiscal year 2023, BMS achieved its first-ever profit of Rs 85 crore, compared to a loss of Rs 92 crore in the previous year.

During the pandemic, BMS faced a decline in revenue as multiplexes and offline entertainment shows were restricted. However, in the last two fiscal years, FY22 and FY23, the company witnessed a significant growth of 13 times. The revenue from operations surged 3.5 times to Rs 976 crore in FY23 from Rs 277 crore in FY22, as per the consolidated financial statements sourced from the Registrar of Companies.

BookMyShow: The Big Picture

The impressive performance of BMS has attracted the interest of other private equity firms such as Carlyle, CVC Capital, and Alpha Wave, who are also considering investments in the company. Avendus is advising BookMyShow in this process.

BMS is expected to achieve a top-line of Rs 1,400 crore in FY24 with an 18-20% EBITDA margin. The majority of the company’s sales, about 65-70%, come from movie tickets.

The revenue from ticket booking accounted for 66% of the total operating revenue, which increased to Rs 648 crore in FY23 from Rs 227 crore in FY22. The remaining revenue is generated from advertising, marketing, streaming, sale of food and beverages, and non-operating income.

Entertainment expenditures in India are broadening beyond the realm of movies to encompass experiential events and live shows. With the touring presence of acts like U2, Ed Sheeran, and others in the country, BMS is venturing into this evolving space.

Read From ET |KKR bets on BookMyShow

According to an analyst, the company’s strong execution capabilities, extensive network, and diverse roster contribute to a compelling investment proposition.