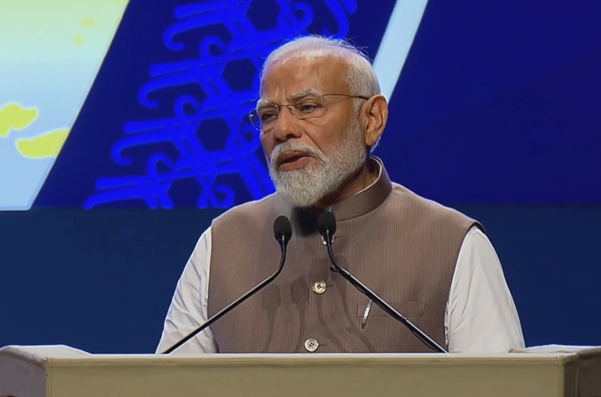

NEW DELHI: Prime Minister Narendra Modi said India needs to become economically self reliant within the next decade to reduce vulnerability to global influences.

While addressing the 90th anniversary ceremony of the Reserve Bank of India in Mumbai on Monday, the PM said that in the next 10 years, India will strive to improve its financial independence, with the country’s economy getting impacted minimally by global developments “as we are already on the way to becoming a world growth engine.”

He also highlighted the potential for job creation once the BJP-led NDA government begins its third term in June.

Shaktikanta Das, who was also present at event, said that the financial sector is stable, and GDP growth is strong.

PM Modi lauds RBI

Over the next 10 years, India must strive to become a ‘financially atmanirbhar’ economy that is shielded from all global events and continues to march ahead confidently for progress and development, PM Modi said.

The PM said that the country’s economy has risen in the last few years from the inherited mess of 2014 when the BJP government took office, and is now poised for take-off.

“India is among the youngest nations in the world… Our policies have opened up new sectors in the economy like green energy, digital technology, Defence which is getting into the export mode, MSMEs, space and tourism industries.

“The RBI must address the aspirations of the youth and develop ‘out-of-the-box’ policies for all these emerging sectors to help the youth,” urged the PM.

Pointing out that globally there is a challenge for nations to strike a balance between inflation control and growth, the PM called upon the RBI to study and develop a model for this, which can be a trendsetter for the world, especially the Global South, while ensuring that the Indian Rupee is accessible and acceptable world over.

Next 10 years target

Aiming for the target for the next 10 years, PM Modi said that the aspirations of the youth of India need to be focused and the RBI has an important role in fulfilling this youth aspiration.

“While deciding the target for the next 10 years, we have to keep one more thing in mind. That is- the aspirations of the youth of India. India is one of the youngest countries in the world today. RBI has an important role in fulfilling this youth aspiration,” he said.

The Prime Minister also said that when the decisions are right, the policies bear the right fruit.

“The transformation occurred because there was honesty and consistency in our efforts. This change has come because our policies, intentions and decisions were clear. When the intentions are clear, then the policies are right. When policies are right, then the decisions are right. And when the decisions are right, the results are also right,” PM Modi said.

‘Transformation of Indian banking sector is a case study’

PM Modi also appreciated the government’s efforts to revive PSU banks, saying that the transformation of the Indian banking sector is a case study. “We left no stone unturned for the growth of the banking sector. The BJP government worked with the policy of recognition, resolution and recapitalization. To improve the situation of the public sector banks, the BJP government infused capital of around Rs. 3.5 lakh crore and also brought reforms related to governance,” the Prime Minister said.

‘UPI has become a globally recognised platform’

Highlighting the growth of Unified Payments Interface (UPI) in the last 10 years, PM Modi said that India has entered a new era of the banking sector, economy and currency exchange. “UPI has become a globally recognised platform. It records over 1200 crore transactions every month. In just 10 years, we have entered a new era of the banking sector, economy and currency exchange. We have to deliberate more on the possibilities of digital transactions. We also have to monitor the channels of a cashless economy and ensure that we foster a financially inclusive culture,” he said.

‘NPAs in banks have fallen to less than 3%’

Additionally, PM Modi said that NPAs in banks have declined to less than 3% in September 2023 from the record high of 11.25% in 2018. “The gross Non Performing Assets (NPA) of the banks, which was around 11.25 per cent in 2018, reached below 3 per cent by September 2023. The ‘twin-balance sheet’ problem is now a thing of the past. Banks now register a credit growth of 15 per cent. RBI has played a significant role in all these accomplishments,” the Prime Minister added.

‘Ease of doing banking’

PM Modi further stressed easy access to credit, promoting ease of banking. RBI’s monetary policy committee has worked very well on inflation targeting, said PM Modi.

“This change has come because our policies, intentions, and decisions were clear. Our efforts had stability and honesty. When intentions are clear, then policies are right. When policies are right, then decisions are right. And when decisions are right, the results are also right,” said PM Modi.

About RBI

The RBI, established in 1935, operates as the country’s central bank as per the recommendations of the Hilton Young Commission and is governed by the Reserve Bank of India Act, 1934.

Initially led by Sir Osborne Smith, the RBI began its operations on April 1, 1935, overseeing currency issuance, banking services, and rural cooperative development.

Over the years, the RBI’s responsibilities have expanded to include monetary management, financial system regulation, foreign exchange management, currency issuance, payment system oversight, and developmental functions.

(With inputs from agencies)

While addressing the 90th anniversary ceremony of the Reserve Bank of India in Mumbai on Monday, the PM said that in the next 10 years, India will strive to improve its financial independence, with the country’s economy getting impacted minimally by global developments “as we are already on the way to becoming a world growth engine.”

He also highlighted the potential for job creation once the BJP-led NDA government begins its third term in June.

Shaktikanta Das, who was also present at event, said that the financial sector is stable, and GDP growth is strong.

PM Modi lauds RBI

Over the next 10 years, India must strive to become a ‘financially atmanirbhar’ economy that is shielded from all global events and continues to march ahead confidently for progress and development, PM Modi said.

The PM said that the country’s economy has risen in the last few years from the inherited mess of 2014 when the BJP government took office, and is now poised for take-off.

“India is among the youngest nations in the world… Our policies have opened up new sectors in the economy like green energy, digital technology, Defence which is getting into the export mode, MSMEs, space and tourism industries.

“The RBI must address the aspirations of the youth and develop ‘out-of-the-box’ policies for all these emerging sectors to help the youth,” urged the PM.

Pointing out that globally there is a challenge for nations to strike a balance between inflation control and growth, the PM called upon the RBI to study and develop a model for this, which can be a trendsetter for the world, especially the Global South, while ensuring that the Indian Rupee is accessible and acceptable world over.

Next 10 years target

Aiming for the target for the next 10 years, PM Modi said that the aspirations of the youth of India need to be focused and the RBI has an important role in fulfilling this youth aspiration.

“While deciding the target for the next 10 years, we have to keep one more thing in mind. That is- the aspirations of the youth of India. India is one of the youngest countries in the world today. RBI has an important role in fulfilling this youth aspiration,” he said.

The Prime Minister also said that when the decisions are right, the policies bear the right fruit.

“The transformation occurred because there was honesty and consistency in our efforts. This change has come because our policies, intentions and decisions were clear. When the intentions are clear, then the policies are right. When policies are right, then the decisions are right. And when the decisions are right, the results are also right,” PM Modi said.

‘Transformation of Indian banking sector is a case study’

PM Modi also appreciated the government’s efforts to revive PSU banks, saying that the transformation of the Indian banking sector is a case study. “We left no stone unturned for the growth of the banking sector. The BJP government worked with the policy of recognition, resolution and recapitalization. To improve the situation of the public sector banks, the BJP government infused capital of around Rs. 3.5 lakh crore and also brought reforms related to governance,” the Prime Minister said.

‘UPI has become a globally recognised platform’

Highlighting the growth of Unified Payments Interface (UPI) in the last 10 years, PM Modi said that India has entered a new era of the banking sector, economy and currency exchange. “UPI has become a globally recognised platform. It records over 1200 crore transactions every month. In just 10 years, we have entered a new era of the banking sector, economy and currency exchange. We have to deliberate more on the possibilities of digital transactions. We also have to monitor the channels of a cashless economy and ensure that we foster a financially inclusive culture,” he said.

‘NPAs in banks have fallen to less than 3%’

Additionally, PM Modi said that NPAs in banks have declined to less than 3% in September 2023 from the record high of 11.25% in 2018. “The gross Non Performing Assets (NPA) of the banks, which was around 11.25 per cent in 2018, reached below 3 per cent by September 2023. The ‘twin-balance sheet’ problem is now a thing of the past. Banks now register a credit growth of 15 per cent. RBI has played a significant role in all these accomplishments,” the Prime Minister added.

‘Ease of doing banking’

PM Modi further stressed easy access to credit, promoting ease of banking. RBI’s monetary policy committee has worked very well on inflation targeting, said PM Modi.

“This change has come because our policies, intentions, and decisions were clear. Our efforts had stability and honesty. When intentions are clear, then policies are right. When policies are right, then decisions are right. And when decisions are right, the results are also right,” said PM Modi.

About RBI

The RBI, established in 1935, operates as the country’s central bank as per the recommendations of the Hilton Young Commission and is governed by the Reserve Bank of India Act, 1934.

Initially led by Sir Osborne Smith, the RBI began its operations on April 1, 1935, overseeing currency issuance, banking services, and rural cooperative development.

Over the years, the RBI’s responsibilities have expanded to include monetary management, financial system regulation, foreign exchange management, currency issuance, payment system oversight, and developmental functions.

(With inputs from agencies)