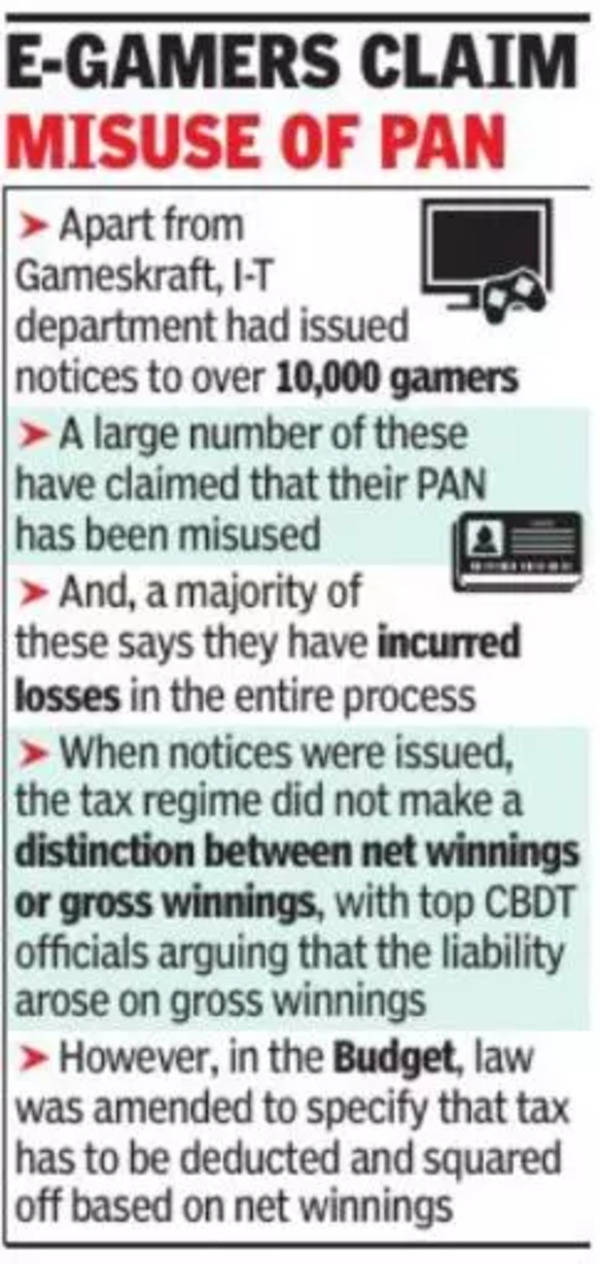

Not only have several of the gamers not responded, but among those who have, a large number have claimed that their PAN has been misused. And, there is a vast majority, which has told department officials, that they have incurred losses in the entire process, having won a few contests but lost many more.

When the notices were issued after scraping data, the tax regime did not make a distinction between net winnings or gross winnings, with top officials in CBDT arguing that the liability arose on gross winnings. It was only in the Budget this year that the law was amended to specify that tax has to be deducted and squared off based on net winnings. In the Budget, FM Nirmala Sitharaman had left the levy unchanged at 30%, but proposed the earlier floor of Rs 10,000 for TDS.

This had raised serious concerns among officials. Having sent out thousands of notices, the officials are now in a dilemma regarding how to process the responses and deal with the case. Taxation of gaming companies has been a bone of contention, with GST Council also debating the mechanism. Despite months of discussion among ministers and officials, the states and the Centre have failed to arrive at a consensus.