Motilal Oswal Financial Services underscores that equity markets will keep a watch on the outcome of this election, as it will have a significant bearing on short-term market behaviour. Siddharth Khemka head (retail research), Motilal Oswal Financial Services, said, Nifty has rallied 10-35% for six months (Nov-May period) till the announcement of election results in the past five consecutive Lok Sabha elections, from 1999 to 2019. “Markets are likely to remain volatile heading into the elections. That being said, history, however, is in favour of a pre-election rally,” he said.

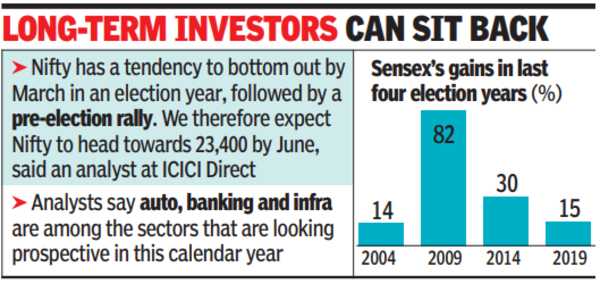

ICICI Direct noted that Indian equity markets have given positive returns in nine out of the past 11 general election years.

“Key takeaway for investors, in our view, is that election year volatility should be embraced as a buying opportunity going by historical inference. Further, Nifty has a tendency to bottom out by March in the general election year, followed by a pre-election rally. We therefore expect Nifty to head toward the 23,400-point mark by June 2024 with a strong support at 21,500 levels,” Pankaj Pandey, head of retail research, ICICI Direct, told TOI.

From a sectoral perspective for a medium to long term, he said, banks have entered a good credit growth cycle, which will lead to business growth and provide operating leverage. “Auto is another sector we are bullish on, with the tailwinds from premiumisation play and EV adoption at an inflexion point,” he added.

Apart from the public sector banks, the infrastructure sector in the railways, roads, port and highways, where govt is driving the capital expenditure initiative, are looking good for this calendar year, said Dharmesh Kant, head (equity & derivative research), Cholamandalam Finance.

“Basically, this is a very safe election for the markets to go into,” he said. Building material supplies, metals, electronics and power sectors are also prospective winners, he said.

Meanwhile, in a recent statement, Value Stocks, a smallcase manager, said that short-term volatility closer to election results is expected, though markets will continue to remain robust over the long run.

We also published the following articles recently

Sensex and Nifty showed gains. Top gainers were HDFC Bank, TCS, Infosys, Maruti Suzuki, Reliance Industries. Market experienced range-bound trading with mid and small-cap stocks under pressure. Various concerns were raised by experts regarding profit booking, SEBI regulations, and specific market sectors.