An official told ET that physical negotiations have commenced, agreeing on the review process modalities to enhance trade relations between the two sides. India has implemented measures like production-linked incentives, higher import tariffs, and import monitoring to boost local manufacturing. However, past trade agreements are being viewed as obstacles.

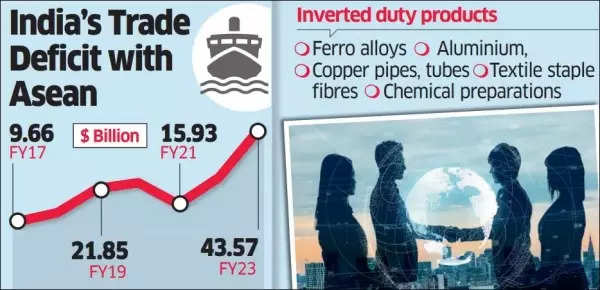

India’s trade deficit with Asean has risen to $43.6 billion in FY23 from $25.8 billion in 2021-22 and $5 billion in 2010-11. Concerns arise as third countries may be leveraging Asean’s duty benefits for exports. Collation of data on the inverted duty structure is underway, with consultations held with the industry.

India’s Trade Deficit With Asean

The focus is on rectifying anomalies related to duty, rules of origin, and non-tariff issues. Specific products like ferro alloys, aluminium, copper pipes, textile staple fibres, and chemical preparations face challenges due to the inverted duty structure.

The Asean comprises Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam

Ajay Sahai, from the Federation of Indian Export Organisations, emphasizes the importance of addressing inverted duty structures in FTAs.

Also Read | Mini-Goldilocks moment! Why Motilal Oswal thinks India is big, bold and blazing

Under the agreement, duties on 75% of goods are to be progressively eliminated, with tariffs reduced on 15% of goods. Variations exist among Asean countries in tariff elimination commitments, affecting the duty structure.

Experts noted that addressing such disparities during annual budgetary processes for imports under the Most Favoured Nation (MFN) principle is relatively straightforward.

However, with the proliferation of FTAs, which typically eliminate import tariffs on numerous finished products, rectifying such imbalances has become increasingly challenging. The ASEAN India FTA is no exception, as tariffs are already set at zero for most industrial products,” stated Ajay Srivastava, co-founder of the economic think tank Global Trade Research Initiative.

Currently, essential raw materials may need to be sourced from non-FTA nations at higher MFN duties, while the end product could be imported duty-free under an FTA.