Axis Bank Wealth Management Services Expands Its Footprint

Axis Bank’s Burgundy Private expands its footprint to 15 new cities

- The Bank is strategically expanding its wealth management services to 15 new cities, increasing its presence to a total of 42 cities across India

- Major focus on emerging markets in Tier 2 cities, which have shown significant growth in savings and investments

National, September 2024: Burgundy Private, Axis Bank’s private banking business, announces the expansion of its wealth management services to 15 new cities, increasing its presence to 42 locations across India. With this strategic move, Burgundy Private will now offer its bespoke wealth management services tailored to the unique needs of discerning clients in India’s rapidly evolving Tier 2 markets.

The new locations, to start with, include Bhubaneswar, Patna, Raipur, Agra, Ghaziabad, Jodhpur, Udaipur, Jalandhar, Meerut, Belgaum, Kozhikode, Thiruvananthapuram, Aurangabad, Nagpur, and Gandhidham. These markets have demonstrated significant growth in investments, with savings and term deposits surpassing the Rs. 1 lakh crore mark*. By leveraging its expertise, technology, and data analytics, Burgundy Private aims to deliver personalised solutions that meet the evolving expectations of affluent clients in these emerging geographies.

Commenting on the expansion, Arjun Chowdhry, Group Executive- Affluent Banking, NRI, Cards/ Payments & Retail Lending, Axis Bank, said, “At Axis Bank, we are committed to delivering world-class wealth management solutions to a growing and discerning set of clients. We recognise the tremendous growth potential in Tier 2 cities and are eager to be a pivotal player in these evolving markets. Our deep understanding of these markets and their financial, cultural, and social nuances allows us to devise bespoke wealth creation and preservation strategies that empower our clients to achieve their goals and financial aspirations.”

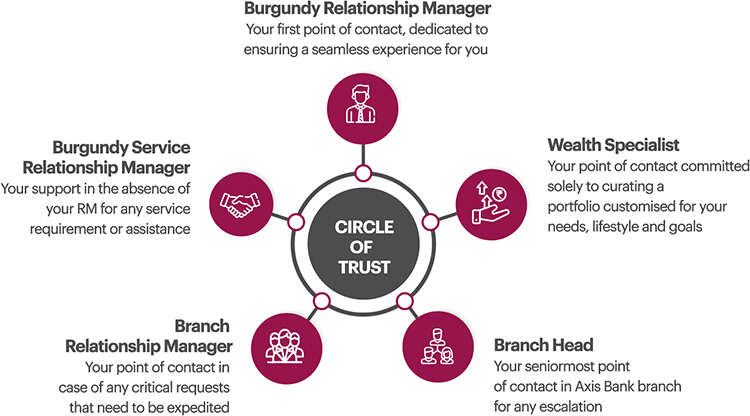

Burgundy Private has an AUM of nearly Rs. 2.07 trillion, a 33% increase YoY, and currently manages wealth for over 13,000 families across 27 cities. Powered by the unique One Axis ecosystem within the Axis Group, Burgundy Private offers a comprehensive suite of products and services to its affluent clients, including banking, loans, cards, investments, insurance, broking, trustee services, investment banking, and NBFC solutions. Through its extensive network of wealth managers, Burgundy Private works closely with its clients, understanding their financial goals and risk appetite to provide holistic and personalised wealth solutions.

In addition to its bouquet of banking and wealth management services, Burgundy Private offers a selection of handpicked experiences encompassing the best of art, culture, lifestyle, and insights for Burgundy Private Clients. Recently, Burgundy Private partnered with Asia Society India Centre to host The Leadership Dialogues that showcase the impact of visionary leaders in driving collective progress. The inaugural event will feature Olympic Gold Medalist Abhinav Bindra in a compelling conversation with a renowned sports journalist.

*As per the RBI data and public resources

About Axis Bank

Axis Bank is one of the largest private sector banks in India. Axis Bank offers the entire spectrum of services to customer segments covering Large and Mid-Corporates, SME, Agriculture, and Retail Businesses. With its 5,427 domestic branches (including extension counters) and 15,014 ATMs across the country as on 30th June 2024. The network of Axis Bank spreads across 2,987 centres, enabling the Bank to reach out to a large cross-section of customers with an array of products and services. The Axis Group includes Axis Mutual Fund, Axis Securities Ltd., Axis Finance, Axis Trustee, Axis Capital, A.TReDS Ltd., Freecharge, Axis Pension Fund and Axis Bank Foundation.

For further information on Axis Bank, please refer to the website: https://www.axisbank.com

About Burgundy Private – Private Banking by Axis Bank

Burgundy Private, Axis Bank’s private banking business, is one of the fastest growing wealth managers in India, managing client assets of over Rs. 2.07 trillion. With access to considerable resources of the Axis Group, Burgundy Private provides bespoke wealth management services along with the power and stability of a leading bank to its private clients.

Headquartered in Mumbai, with a strong team of over 260 Private Bankers, Burgundy Private manages the wealth of more than 13,000 illustrious families across 27 locations in India. The clientele comprises of some of the most distinguished families in the country, including 35 of India’s top 100 families in terms of their net worth.

Burgundy Private brings to its clients a comprehensive platform that provides tailored services across wealth management, investment advisory, family-office solutions, personal & corporate banking, family governance & succession-planning and tax advisory.

Burgundy Private offers Investment Advisory and Family Office Services through Axis Securities Limited. For more information, please visit www.burgundyprivate.com