So, 2024-25 could be the year when the car industry, which has been moving up strongly for past three years, witnesses muted growth as demand shrinks and inventories build-up at dealerships, industry officials and analysts told TOI.

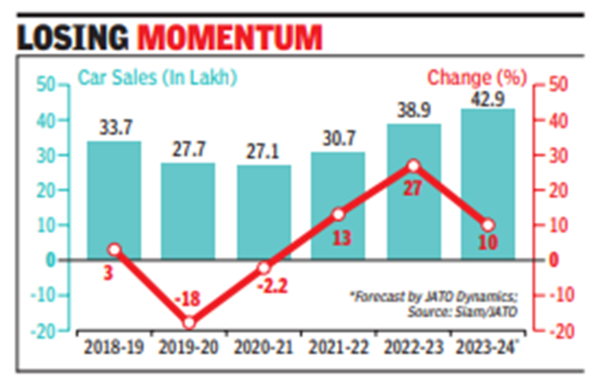

According to experts, the car market, which is likely to close the current fiscal on record volumes of 42.9 lakh units, has developed a heavy base and may “see some time” before it starts to grow fast again. Also, pace at which consumers booked and bought cars during last three years may now see a slowdown as the pent-up demand has been fulfilled and a breather comes into play.

“There are a variety of factors that will keep growth muted in FY25. Apart from a heavier base, the reasons also include cars getting expensive during the previous years and Covid production shortfall being met subsequently,” says Ravi Bhatia, president and director at research firm JATO Dynamics. “Also, used cars will take up a share from new car sales, especially in the entry category.”

After the initial worries around demand during the outbreak of Covid in March 2020, the pace of turnaround in sales had taken almost everyone by surprise

The phenomenon, which coincided with severe global shortages in supply of semiconductors, saw huge waiting periods across brands, with pending deliveries rising to as high as 7 lakh units at one point in time. With companies gradually ramping up production and semiconductor availability easing up, most of the pent-up demand has been fulfilled, leading to a situation where companies are now pushing models through special campaigns and discounts.

“Going by the current analysis, it looks like growth would be muted, or at best be in low single digit,” Shashank Srivastava, senior executive officer (sales & marketing) at Maruti Suzuki, says.

Kunal Behl, VP (marketing & sales) at Honda Cars India, also says that going may get tougher for the industry.