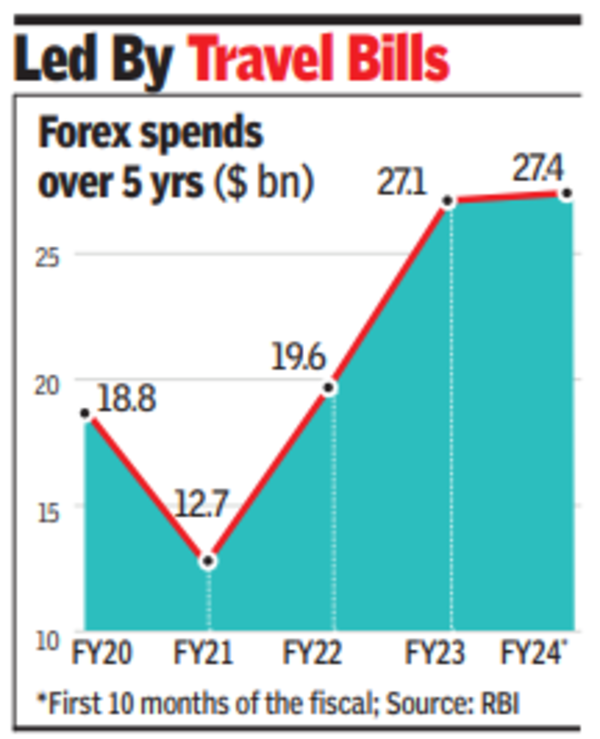

MUMBAI: Foreign exchange remittances for the first 10 months of FY24 stood at $27.4 billion, crossing the FY23 level of $27.1 billion. This is despite the introduction of tax collection at source (TCS) in the Budget.

With average monthly remittances in FY24 touching $2.7 billion, the total foreign exchange sent abroad under the liberalised remittance scheme (LRS) is set to cross $30 billion during the current financial year, setting a new record.

With average monthly remittances in FY24 touching $2.7 billion, the total foreign exchange sent abroad under the liberalised remittance scheme (LRS) is set to cross $30 billion during the current financial year, setting a new record.

Outward remittances rose during Jan 2024 to $2.6 billion from $2.4 billion in Dec, owing to a surge in spending on foreign education. Despite govt introducing TCS from Oct 2023, forex spending is increasing to earlier levels. For instance, the Jan forex spending by Indians was 3.5% lower than the $2.7 billion in Jan 2023, before the TCS imposition.

Within total forex remittances, spending on travel in Jan at $1.54 billion was unchanged compared to Dec 2023. The figure was, however, higher than $1.49 billion in the year-ago period. Dealers said the Jan travel was also linked to students travelling overseas for education.